Best Travel Insurance For Schengen Visa From the UK, Travel insurance for a Schengen visa is mandatory. It must cover at least €30,000 in medical expenses.

Travel insurance is crucial for obtaining a Schengen visa. It provides coverage for medical emergencies, accidents, and repatriation. This insurance ensures travelers receive adequate medical care without incurring high costs. Policies must meet specific requirements set by Schengen countries. They should cover the entire duration of the stay and be valid across all Schengen states.

Purchasing compliant travel insurance not only fulfills visa requirements but also provides peace of mind. Reliable insurance can make a significant difference in unforeseen situations. Always review the policy details thoroughly before buying to ensure it meets all Schengen visa criteria.

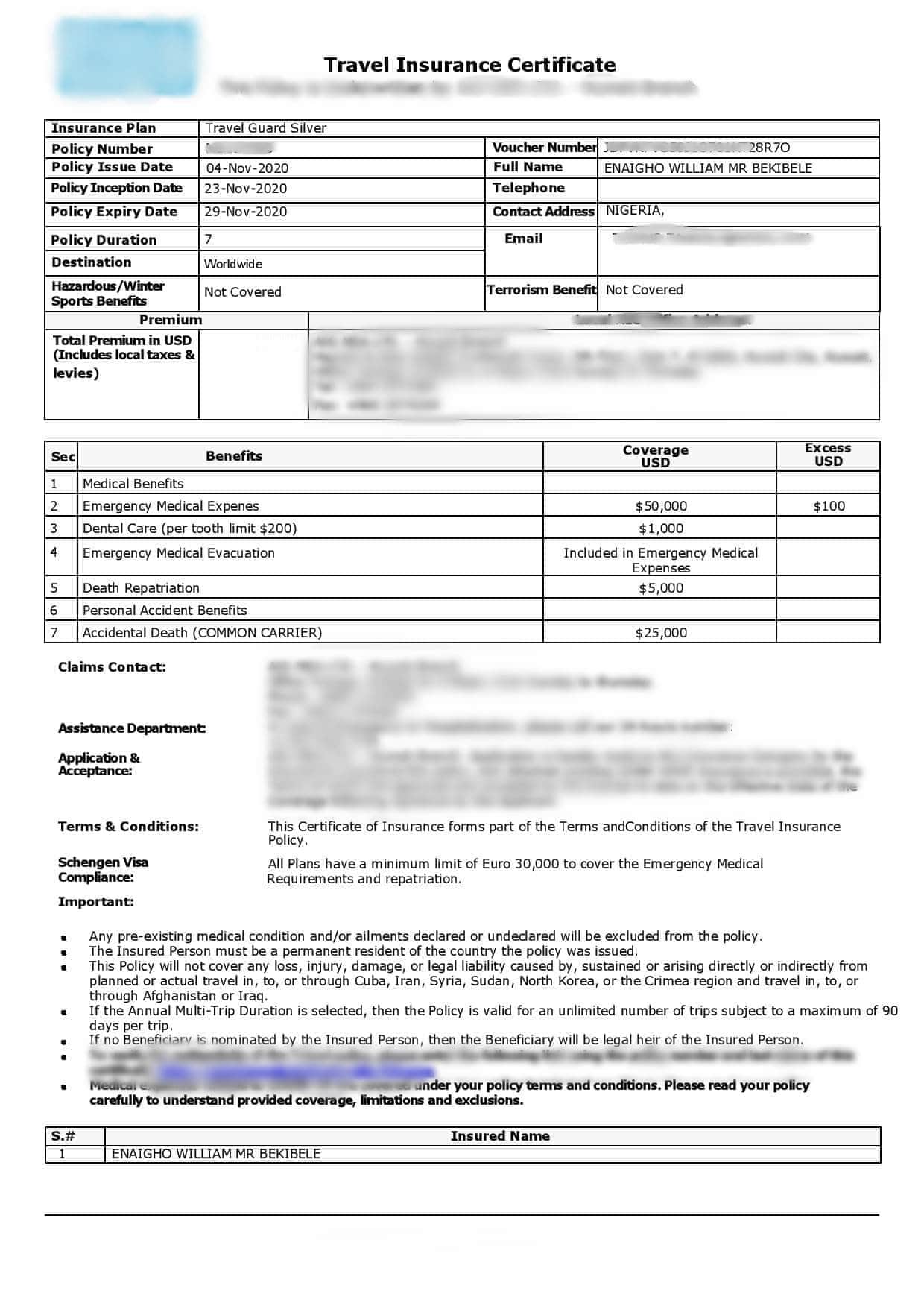

Credit: www.bookingreservationforvisa.com

Introduction To Best Travel Insurance For Schengen Visa From the UK

Traveling to Europe can be a dream come true. If you plan to visit multiple countries in Europe, you might need a Schengen Visa. One essential requirement for this visa is travel insurance. This guide explains the importance of Schengen travel insurance and how it helps you.

The Schengen Visa Explained

The Schengen Visa allows you to travel freely within the Schengen Area. This area includes 27 European countries. With this visa, you do not need separate visas for each country. It simplifies travel across Europe.

To get a Schengen Visa, you must meet several requirements. One key requirement is having valid travel insurance. This insurance must cover you for the entire duration of your stay.

Role Of Travel Insurance In Schengen Visas

Travel insurance is crucial for obtaining a Schengen Visa. It ensures you have financial protection during your trip. Your insurance must meet specific criteria:

- Minimum coverage of €30,000.

- Coverage for all Schengen countries.

- Coverage for medical emergencies, hospitalization, and repatriation.

The insurance must be valid for the entire duration of your stay. It ensures you receive medical care if needed. It also covers unexpected events like trip cancellations or lost baggage.

Here is a quick comparison of different travel insurance providers:

| Provider | Coverage Amount | Medical Coverage | Trip Cancellation |

|---|---|---|---|

| Provider A | €30,000 | Yes | Yes |

| Provider B | €50,000 | Yes | No |

| Provider C | €100,000 | Yes | Yes |

Choosing the right travel insurance ensures peace of mind. It protects you against unforeseen events. Always read the policy details carefully.

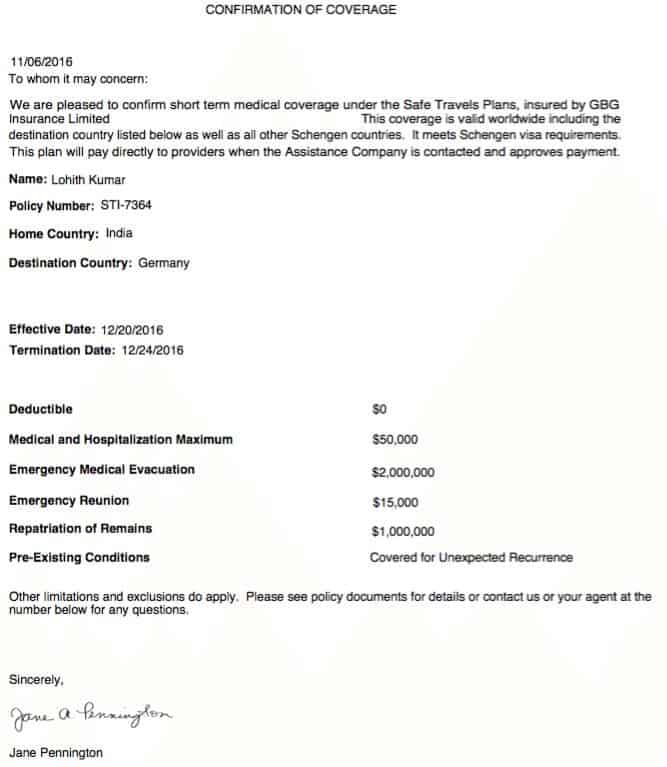

Credit: schengenflightreservationvisa.com

Mandatory Insurance Requirements

Travel insurance is a critical requirement for obtaining a Schengen visa. Travelers must meet specific insurance criteria to be eligible. These requirements ensure that travelers are covered in case of emergencies or unforeseen events. Below are the mandatory insurance requirements for a Schengen visa.

Minimum Coverage Needed

Schengen visa insurance policies must meet minimum coverage standards. The coverage must be at least €30,000. This amount should cover any medical expenses due to illness or injury.

The insurance must be valid for the entire Schengen area. It should cover the entire duration of your stay. This ensures that you are protected no matter where you travel within the Schengen zone.

Medical And Repatriation Coverage

Your travel insurance must include medical and repatriation coverage. This is crucial for Schengen visa approval. Medical coverage should handle expenses like hospitalization, surgery, and emergency treatments.

Repatriation coverage is equally important. It covers the cost of returning to your home country in case of severe illness or death. This ensures that you and your family are protected in worst-case scenarios.

| Coverage Type | Description |

|---|---|

| Medical Coverage | Covers medical expenses such as hospital stays and surgeries. |

| Repatriation Coverage | Handles costs of returning to your home country. |

| Minimum Coverage | At least €30,000 for medical expenses. |

| Validity | Must cover the entire Schengen area and duration of stay. |

Ensure your travel insurance meets these mandatory requirements. It will make your Schengen visa application smoother and safer.

Choosing The Right Travel Insurance

Travel insurance is essential for a Schengen Visa. It protects you from unexpected events. Choosing the right travel insurance ensures you are covered for every situation.

Coverage Options And Limitations

Understanding the coverage options is crucial. Here are some common coverage options:

- Medical Expenses: Covers hospital stays and doctor visits.

- Trip Cancellation: Reimburses non-refundable trip costs.

- Lost Luggage: Compensates for lost or stolen baggage.

- Flight Delays: Provides compensation for delayed flights.

Always check the limitations of your policy. Some policies have exclusions:

- Pre-existing Conditions: Medical conditions before buying the insurance.

- Adventure Activities: Activities like skiing or skydiving.

- Travel to High-Risk Countries: Countries with travel advisories.

Make sure to read the fine print. Ensure the policy meets Schengen Visa requirements.

Selecting A Trusted Insurance Provider

Choosing a trusted provider is vital. A reliable provider offers comprehensive coverage. Here are steps to find a trusted provider:

- Research: Look for reviews and ratings online.

- Compare: Compare different policies and prices.

- Verify: Ensure the provider is recognized by Schengen countries.

- Customer Service: Check the quality of customer support.

Look for insurance companies with a proven track record. Trusted providers offer peace of mind during your travels.

Avoid choosing based solely on price. The cheapest option may not provide adequate coverage. Invest in a policy that offers the best protection.

Here is a table comparing some top providers:

| Provider | Coverage Options | Customer Rating |

|---|---|---|

| Provider A | Medical, Trip Cancellation, Lost Luggage | 4.5/5 |

| Provider B | Medical, Flight Delays, Lost Luggage | 4.3/5 |

| Provider C | Medical, Trip Cancellation, Adventure Activities | 4.7/5 |

Choose the provider that best fits your needs. Ensure they comply with Schengen Visa requirements.

Benefits Of Comprehensive Coverage

Travel insurance for a Schengen visa offers many benefits. One key advantage is comprehensive coverage. This ensures travelers are protected against various risks.

Trip Cancellation And Interruption

Unexpected events can force you to cancel or interrupt your trip. With trip cancellation and interruption coverage, you can recover non-refundable expenses. This includes flights, hotels, and tours.

Here are some reasons why you might need this coverage:

- Medical emergencies

- Natural disasters

- Personal emergencies

This coverage gives peace of mind. You can travel without worrying about unforeseen events.

Lost Or Stolen Luggage

Lost or stolen luggage can ruin your trip. Comprehensive travel insurance covers your belongings. You can get compensation for lost or stolen items.

The policy often covers:

- Clothing

- Electronics

- Personal items

This ensures you can replace essential items quickly. You can continue your trip without major disruptions.

Understanding Claims And Reimbursements

Travel insurance is crucial for a Schengen Visa. It safeguards against unforeseen expenses during travel. But understanding claims and reimbursements can be confusing. This section breaks down the process for you.

Filing A Claim

To file a claim, gather all necessary documents. This includes your insurance policy, receipts, medical reports, and any other relevant paperwork. Make sure to submit accurate and complete information.

Follow these steps to file a claim:

- Contact your insurance provider as soon as possible.

- Fill out the claim form provided by your insurer.

- Attach all required documents to the claim form.

- Submit the completed claim form and documents to your insurer.

Keep copies of everything you submit. This ensures you have records in case of disputes.

What To Expect During Reimbursement

The reimbursement process can vary based on your insurer. Generally, it involves several stages.

Initial Review: The insurer reviews your claim for completeness. Missing information can delay the process.

Assessment: The insurer evaluates the validity of your claim. They check the details against your policy coverage.

Approval or Denial: If approved, the insurer processes your reimbursement. If denied, they provide reasons for the denial.

Once approved, reimbursements usually occur within a few weeks. The exact time frame depends on your insurer’s policies.

Here is a table summarizing the reimbursement stages:

| Stage | Description |

|---|---|

| Initial Review | Checking for completeness |

| Assessment | Evaluating claim validity |

| Approval or Denial | Decision and processing |

Monitor the status of your claim regularly. Stay in touch with your insurer for updates.

Credit: schengenvisaexperts.com

Travel Insurance For Different Travelers

Travel insurance for different travelers ensures everyone’s needs are met. Whether you travel alone or with family, there’s a plan for you. This guide will help you find the right insurance for your Schengen visa.

Insurance For Solo Travelers

Solo travelers have unique needs. They need coverage that includes emergency medical expenses, trip cancellations, and lost luggage. Solo travelers should also consider policies that offer 24/7 assistance. This ensures they get help anytime they need it.

Here are some key benefits for solo travelers:

- Emergency medical coverage: Covers medical costs if you get sick or injured.

- Trip cancellation: Reimburses you if you need to cancel your trip.

- Lost luggage: Helps replace your belongings if your luggage is lost.

- 24/7 assistance: Provides help anytime during your trip.

Family And Group Travel Insurance Plans

Traveling with family or a group needs special insurance. These plans cover multiple people under one policy. This makes managing the policy easier and often more affordable.

Key benefits for family and group travel insurance include:

- Medical emergencies: Covers medical costs for all family members.

- Trip cancellation: Reimburses for trip cancellations for any group member.

- Lost luggage: Helps replace belongings if anyone’s luggage is lost.

- Family activities: Covers activities that the whole family enjoys.

A comparison table for solo and group travel insurance:

| Feature | Solo Travel Insurance | Family/Group Travel Insurance |

|---|---|---|

| Emergency Medical Coverage | Yes | Yes |

| Trip Cancellation | Yes | Yes |

| Lost Luggage | Yes | Yes |

| 24/7 Assistance | Yes | Yes |

| Family Activities Coverage | No | Yes |

Choose the right travel insurance for your Schengen visa. This ensures a safe and worry-free trip.

Common Exclusions And Limitations

Travel insurance for a Schengen visa is essential. It offers peace of mind and financial protection. But, it’s crucial to understand common exclusions and limitations.

Pre-existing Conditions

Most travel insurance policies exclude pre-existing medical conditions. If you have a health issue before buying the policy, it may not be covered. This includes chronic illnesses like diabetes or heart disease. Always check if your condition is listed in the exclusions.

| Type of Condition | Covered |

|---|---|

| Diabetes | No |

| Asthma | No |

| High Blood Pressure | No |

Activities Not Covered

Travel insurance may not cover high-risk activities. These include extreme sports like bungee jumping or scuba diving. If you plan to engage in such activities, check your policy.

- Bungee Jumping – Not Covered

- Scuba Diving – Not Covered

- Sky Diving – Not Covered

Some policies offer add-ons for these activities. But, they may come at an extra cost. Always read the fine print to avoid surprises.

Navigating The Application Process

Applying for travel insurance is crucial for a Schengen visa. The process might feel overwhelming, but breaking it down helps. Here’s a step-by-step guide to make it easier.

Documents Required For Insurance Application

Before applying for travel insurance, gather these documents:

- Passport copy: Ensure it’s valid for at least six months.

- Visa application form: Complete and signed.

- Travel itinerary: Details of your travel plans.

- Proof of accommodation: Hotel bookings or invitation letter.

- Proof of financial means: Bank statements or sponsorship letter.

Having these documents ready speeds up the process.

Visa Application And Insurance Documentation

Align your visa application with your insurance documentation. Here’s how:

- Ensure your travel dates on the insurance match your itinerary.

- Check the insurance coverage meets Schengen visa requirements.

- Print copies of your insurance policy. Submit them with your visa application.

- Double-check your insurance covers all Schengen countries.

Consistency between your visa application and insurance documents is vital. It reduces the chances of delays or rejections.

Tips For A Hassle-free Schengen Visa

Securing a Schengen Visa can be stressful. But, with the right tips, it gets easier. Here are some essential tips to ensure a hassle-free experience:

Read The Fine Print

Always read the fine print of your travel insurance policy. This helps you understand what is covered. Pay attention to the coverage limits and exclusions. Knowing these details can save you from unexpected costs.

Check the medical coverage amount. It should meet the Schengen Visa requirements. Make sure emergency services are included. This includes medical evacuation and repatriation.

Prepare For The Unexpected

Travel plans can change quickly. Your travel insurance should cover trip cancellations and delays. Look for policies that offer compensation for these situations.

Ensure your policy covers lost luggage. This can be a lifesaver if your bags go missing. Also, check if it includes theft protection. Protecting your valuables is crucial during travel.

Some policies offer 24/7 assistance. This can be very helpful in an emergency. Make sure you have the contact details handy.

Conclusion: Peace Of Mind While Traveling

Traveling to Schengen countries is a dream for many. Yet, without travel insurance, it can be risky. Travel insurance ensures safety and peace of mind.

The Importance Of Being Insured

Travel insurance is essential for any trip to Schengen countries. It covers medical emergencies, trip cancellations, and lost luggage. With insurance, travelers avoid unexpected expenses. Schengen visa requirements mandate travel insurance. This ensures tourists are protected during their stay.

Ensuring A Safe And Enjoyable Trip

Travel insurance guarantees a safe and enjoyable journey. It covers unforeseen events like accidents or illness. Coverage includes medical treatment and hospital stays. Insurance also protects against trip interruptions. This allows travelers to relax and enjoy their vacation.

- Medical emergencies: Coverage for unexpected illnesses or injuries.

- Trip cancellations: Reimbursement for non-refundable expenses.

- Lost or stolen luggage: Compensation for lost personal items.

Choose a plan that fits your needs. Compare different policies and their benefits. Ensure the policy meets Schengen visa requirements. Always read the fine print and understand the coverage limits. This way, you avoid surprises during your trip.

Frequently Asked Questions

What Is Schengen Travel Insurance?

Schengen travel insurance covers medical emergencies, repatriation, and trip disruptions within the Schengen Area.

Why Do I Need Schengen Visa Insurance?

Schengen visa insurance is mandatory for visa approval. It ensures financial protection during medical emergencies.

What Should Schengen Insurance Cover?

It must cover at least €30,000 for medical expenses, emergency repatriation, and hospitalization.

How To Choose The Best Schengen Insurance?

Compare various plans. Look for comprehensive coverage, affordable premiums, and reputable insurers.

Is Schengen Visa Insurance Expensive?

Costs vary. Typically, it’s affordable, starting from a few euros per day, depending on coverage and duration.

Can I Buy Schengen Insurance Online?

Yes, many insurers offer online purchase options. It’s quick, convenient, and you can compare plans easily.

What Happens If I Travel Without Insurance?

Traveling without insurance risks visa rejection and potential financial liabilities for medical emergencies.

Does Schengen Insurance Cover Covid-19?

Many insurers now include COVID-19 coverage. Check the policy details to ensure it meets your needs.

Conclusion

Securing travel insurance for your Schengen visa is essential. It ensures peace of mind and financial protection. With comprehensive coverage, you can enjoy your trip without worries. Always choose a reliable provider that meets Schengen requirements. Travel safe and make the most of your European adventure.

Author Info

Leave a reply